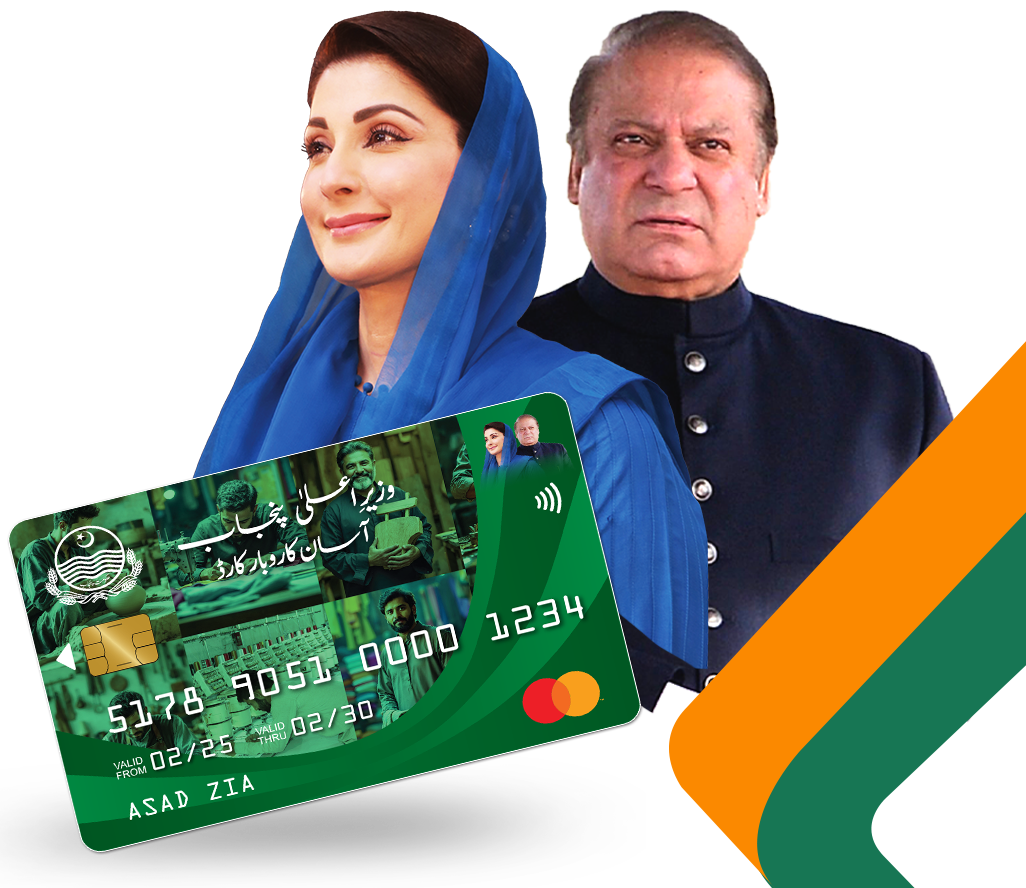

Punjab Asaan Karobar Card 2025 is a flagship initiative by the Government of Punjab aimed at empowering small entrepreneurs with interest-free loans up to PKR 1 million. Through a digital SME card,Punjab Asaan Karobar Card 2025 supports business growth and sustainability by offering easy access to funds via digital platforms like mobile apps and POS systems.

Key Features of Punjab Asaan Karobar Card 2025

| Feature | Details |

|---|---|

| Maximum Loan Limit | PKR 1,000,000 |

| Loan Tenure | 3 Years |

| Loan Type | Revolving credit for 12 months |

| Repayment Period | 24 Monthly Installments (after 1st year) |

| Grace Period | 3 Months after card issuance |

| Interest Rate | 0% |

| Usage Allowed | Business-related expenses only |

Eligible Loan Usage Punjab Asaan Karobar Card 2025

- Payments to vendors and suppliers

- Utility bills, government taxes, and fees

- Business-related cash withdrawals (up to 25% limit)

- Digital payments via POS or mobile app

Eligibility Criteria for Punjab Asaan Karobar Card 2025

To apply for the Punjab Asaan Karobar Card 2025 , applicants must meet the following conditions:

- Age: 21 to 57 years

- Pakistani national with Punjab residency

- Valid CNIC and mobile number (in applicant’s name)

- Must own or plan to start a business in Punjab

- Satisfactory credit history

- Pass psychometric and credit assessment

- Only one application per person/business

- No overdue or defaulted bank loans

How to Apply for Punjab Asaan Karobar Card 2025

- Apply online through the PITB digital portal

- Pay a non-refundable fee of PKR 500

- Digital verification of CNIC, credit check, and business site

- Approval based on proper documentation and assessment

Loan Utilization and Repayment Plan for Punjab Asaan Karobar Card 2025

| Phase | Details |

|---|---|

| First 50% Limit | Available during the first 6 months |

| Grace Period | 3 months after card issuance |

| Installments | Begin after grace period with minimum 5% monthly payment of principal |

| Remaining 50% | Released after regular usage, repayment & PRA/FBR registration |

| Final Repayment | 2 years of equal monthly installments (EMIs) after the first year |

Charges and Fees for Punjab Asaan Karobar Card 2025

- Annual Card Fee: PKR 25,000 + FED (deducted from loan limit)

- Other Costs: Life assurance, card issuance & delivery – covered under the scheme

- Late Payments: Charges applied as per bank’s schedule of charges

Security and Verification of Punjab Asaan Karobar Card 2025

- Digitally signed personal guarantee by the applicant

- Life assurance coverage provided

- Business premises physically verified within 6 months (and annually)

Key Conditions of the Punjab Asaan Karobar Card 2025

- Loan strictly for business-related activities only

- Non-business or personal spending is blocked

- Mandatory PRA/FBR registration within 6 months of card issuance

- Only one application per person/business allowed

Support for Applicants Punjab Asaan Karobar Card 2025

- Feasibility Studies available for new business ideas Check: PSIC and BOP official websites

- Dedicated Helpline: Call 1786 for assistance

Tier-Wise Loan Details

| Tier | Amount (PKR) | Security | Tenure | Interest Rate | Processing Fee |

|---|---|---|---|---|---|

| T1 | 1M – 5M | Personal Guarantee | 5 Years | 0% | PKR 5,000 |

| T2 | 6M – 30M | Secured (Collateral) | 5 Years | 0% | PKR 10,000 |

Grace Period and Equity Contribution

- Startups/New Businesses: Up to 6 months

- Existing Businesses: Up to 3 months

| Type | Equity Contribution |

|---|---|

| General Loans (T1 & T2) | 20% |

| Leased Vehicles | 25% |

| Female, Transgender, Disabled | 10% |

| T1 (non-vehicle) | 0% |

Purpose of Loan for Punjab Asaan Karobar Card 2025

- New Businesses: Startup capital and setup

- Existing Businesses: Working capital, expansion, or tech upgrades

- Leasing: Logistics and transport business

- Green Businesses: Environment-friendly initiatives (RECP)

CM Punjab’s Vision

“The Punjab Asaan Karobar Card 2025 is more than a financial tool – it’s a path to prosperity for the hardworking entrepreneurs of Punjab. This initiative brings ease, transparency, and opportunity to every doorstep.”

— Chief Minister Punjab

Current Update for Punjab Asaan Karobar Card 2025

- Registration is temporarily closed

- For more updates, visit: https://akc.punjab.gov.pk/cmpunjabfinance

For more updates on government welfare programs, visit PakGovSchemes.pk

Punjab Asaan Karobar Card 2025 (FAQs)

Q1. Who can apply for the Punjab Asaan Karobar Card 2025

Anyone aged 21-57 years with a business in Punjab and valid CNIC/mobile number.

Q2. Is the loan really interest-free?

Yes, the loan carries 0% interest for the borrower.

Q3. Can I use the loan for personal needs?

No. It is strictly for business-related purposes only.

Q4. Is there a processing fee for apply Punjab Asaan Karobar Card 2025?

Yes. A PKR 500 non-refundable fee is required with the application.

Q5. What happens if I miss a payment?

Late payment charges will apply as per the bank’s policy.

Q6. How can I check my loan application status?

You can check status online via the PITB portal after applying